2025年3月16日,新规国家卫生健康委、速递实验室何市场监管总局发布《食品安全国家标准——食品中多元素的应对测定》。根据《中华人民共和国食品安全法》规定,新规经食品安全国家标准审评委员会审查通过,速递实验室何发布了《食品安全国家标准预包装食品标签通则》(GB 7718-2025)等50项食品安全国家标准和9项修改单。应对

其中GB 5009.268-2016《食品安全国家标准 食品中多元素的新规测定》也于此次发布,并将于2025年9月16日正式实施。速递实验室何为帮助广大食品检测同仁快速掌握标准中的应对修订变化,伟业计量与您一块梳理。新规

相较于前一版本GB 5009.268-2016,速递实验室何2025版标准在技术内容和适用范围上进行了优化和扩展。应对

主要变化包括可能扩大了适用的新规食品种类范围或增加了需检测的元素种类,引入了更先进的速递实验室何分析技术和方法以提高检测灵敏度,并根据最新科学研究对某些元素的应对允许限量进行了调整。此外,标准还优化了采样和前处理方法,强化了实验室质量控制要求,实现了检测方法的统一。

主要修订内容有:将原第一法和第二法修改为第一篇第一法和第二法,其中第一法增加了锂、磷、硫和铷的测定,修改了乳与乳制品、特殊膳食用食品中铬、锰、铅等的方法检出限和定量限,第二法增加了砷、镉、钴、铬、钼、铅、硫、硒和锡的测定;增加了第二篇复配食品营养强化剂中多元素的测定。

该标准的实施为食品中多元素的检测提供了统一的技术规范,有助于保障食品安全和公众健康。通过规范检测方法和技术指标,标准能够有效监测食品中的重金属和其他有害元素含量,为食品安全监管提供科学依据。同时,标准的统一也便于企业遵循和执行,减少了检测过程中的混乱,提高了检测数据的可靠性和可比性。

为了配合新标的精准落地,伟业计量推出对应检测标准物质,为风险预警和溯源管理提供可靠依据。

完整查看方案请下载查看:《新规GB 5009.268-2025伟业计量产品方案》

部分示例如下:

1. 单元素标准贮备液

| 产品编号 | 产品名称 | 产品规格 | 标准值 | |

| GBW(E)086340 | 金标准溶液标准物质 | 50mL | 100μg/mL | |

| BWB2194-2016 | 锂元素溶液标准物质 | 50mL | 100μg/mL | |

| BWB2271-2016 | 硼元素溶液标准物质 | 50mL | 100μg/mL | |

| GBW(E)086211 | 钠单元素溶液标准物质 | 50mL | 100μg/mL | |

| GBW(E)086215 | 镁单元素溶液标准物质 | 50mL | 100μg/mL | |

| BWB2192-2016 | 铝元素溶液标准物质 | 50mL | 100μg/mL | |

| BWZ7182-2016 | 水中磷溶液标准物质 | 50mL | 100μg/mL | |

| BWZ7386-2016 | 硫元素溶液标准物质 | 50mL | 10000μg/mL | |

| GBW(E)086213 | 钾单元素溶液标准物质 | 50mL | 100μg/mL | |

| GBW(E)083796 | 钙标准溶液标准物质 | 50mL | 100μg/mL | |

| BWB2213-2016 | 钛元素溶液标准物质 | 50mL | 100μg/mL | |

| BWB2188-2016 | 钒元素溶液标准物质 | 50mL | 100μg/mL | |

| GBW(E)083785 | 铬标准溶液标准物质 | 50mL | 100μg/mL | |

| BWB2176-2016 | 锰元素溶液标准物质 | 50mL | 100μg/mL | |

| GBW(E)086261 | 铁单元素溶液标准物质 | 50mL | 100μg/mL | |

2. 多元素混标

| 产品编号 | 产品名称 | 产品规格 | 标准值 | |

| BWB2620-2016 | 30种金属混标(符合5750.6-2023 4.5) | 100mL*2 | 30组分 | |

| BWB2502-2016 | 32种金属元素混合标准物质(HJ 776-2015) | 100mL | 32组分 | |

| BWB2529-2016 | 47种金属混合溶液标准物质 | 100mL | 47组分 | |

| BWB2553-2016 | 33种金属混合溶液标准物质 | 100mL*2 | 33组分 | |

| BWB2664-2016 | 25种金属元素混合溶液标准物质 | 100mL | 25组分 | |

| BWB2481-2016 | 26种金属元素混合标准溶液(ICP-MS法,适用GB 5009.268-2016) | 50mL*4 | 26组分 | |

| SHAM_176508 | ICP-MS用26种金属溶液标准物质 | 100mL | 26组分 | |

| BWB2535-2016 | GB/T 5750.6-2006 1.4 27种金属混合溶液标准物质 | 100mL | 27组分 | |

| BWB2565-2016 | 28种金属元素混合溶液标准物质 | 100mL | 28组分 | |

3. 奶粉基体质控样

| 产品编号 | 产品名称 | 产品规格 | 标准值 | |

| GBW10309 | 德国奶粉中26种元素成分分析标准物质 | 30g | 59组分 | |

| BWS0101-2016 | 奶粉中铅质控样品 | 20g | 0.202mg/kg | |

| BWS0075-2016 | 奶粉中钾质控样品 | 20g | 9.48g/kg | |

| BWS0096-2016 | 奶粉中铅、镉质控样品 | 20g | 2组分 | |

| BWS0102-2016 | 奶粉中铬质控样品 | 20g | 1.95mg/kg | |

| BWS0074-2016 | 奶粉中钙质控样品 | 20g | 11.14g/kg | |

| BWS0088-2016 | 奶粉中4种元素质控样品(钾、钠、钙、镁) | 20g | 4组分 | |

| BWS0092-2016 | 奶粉中钠质控样品 | 20g | 3.15g/kg | |

| BWS0091-2016 | 奶粉中铁质控样品 | 20g | 4.17mg/kg | |

| BWS0076-2016 | 奶粉中铜质控样品 | 20g | 0.28mg/kg | |

4. 茶叶基体质控样

| 产品编号 | 产品名称 | 产品规格 | 标准值 | |

| GBW10305 | 绿茶(高山茶)成分分析标准物质 | 20g | 59组分 | |

| BWS0152-2016 | 茶叶中铅、镉、总砷、铜、锌、铁六种元素分析质控样品 | 40g | 6组分 | |

| BWS0146-2016 | 茶叶中镉分析质控样品 | 40g | 110.6mg/kg | |

| BWS0150-2016 | 茶叶中铜分析质控样品 | 40g | 128.1mg/kg | |

| BWS0149-2016 | 茶叶中铁分析质控样品 | 40g | 213.7mg/kg | |

| BWS0151-2016 | 茶叶中锌分析质控样品 | 40g | 124.4mg/kg | |

| BWS0144-2016 | 茶叶中铅分析质控样品 | 40g | 118.5mg/kg | |

| BWS0148-2016 | 茶叶中砷分析质控样品 | 40g | 111.2mg/kg | |

5. 大米基体质控样

| 产品编号 | 产品名称 | 产品规格 | 标准值 | |

| GBW10294 | 镉污染(富硒)大米粉无机成分分析标准物质 | 30g | 56组分 | |

| GBW(E)100987 | 湖南大米粉无机成分分析标准物质 | 30g | 56组分 | |

| GBW(E)100984 | 四川大米粉无机成分分析标准物质 | 30g | 56组分 | |

| GBW(E)100983 | 辽宁大米粉无机成分分析标准物质 | 30g | 59组分 | |

| GBW(E)100988 | 镉污染大米粉无机成分分析标准物质 | 25g | 59组分 | |

| GBW(E)100986 | 四川(高硒)大米粉无机成分分析标准物质 | 30g | 59组分 | |

| BWS0351-2016 | 大米粉中铅、镉质控样品 | 40g | 2组分 | |

| BWS0059-2016 | 大米粉中铜质控样品 | 40g | 4.29mg/kg | |

| BWS0046-2016 | 大米粉中铅质控样品 | 40g | 1.29mg/kg | |

| BWS0035-2016 | 大米粉中汞质控样品 | 30g | 0.58mg/kg | |

| GBW(E)100356 | 大米粉成分分析标准物质 | 35g | 6组分 | |

| BWS0047-2016 | 大米粉中无机砷质控样品 | 15g | 0.44mg/kg | |

| BWQ9418-2016 | 大米粉中镉质控样品 | 40g | 0.31mg/kg | |

| BWS0045-2016 | 大米粉中铬质控样品 | 40g | 0.45mg/kg | |

| BWQ9400-2016 | 大米粉中无机砷质控样品 | 40g | 2.29mg/kg | |

| BWS0058-2016 | 大米粉中镍质控样品 | 40g | 1.27mg/kg | |

6. 蔬菜基体质控样

| 产品编号 | 产品名称 | 产品规格 | 标准值 | |

| SHAM_213498 | (青菜粉)蔬菜中铅、铬、镉、砷、汞质控样品 | 30g/瓶 | Mix(5组分) | |

| SHAM_169113 | (菠菜粉)蔬菜中铅、砷、镉质控样品 | 30g/瓶 | Mix(3组分) | |

| SHAM_169035 | (青菜粉)蔬菜中砷质控样品 | 30g/瓶 | 见证书 | |

| SHAM_169017 | (香菇粉)蔬菜中汞质控样品 | 30g/瓶 | 见证书 | |

| SHAM_169015 | (菜花粉)蔬菜中砷质控样品 | 30g/瓶 | 见证书 | |

| SUGG_227184 | (菠菜粉)蔬菜中铅、镉、铬、砷、铜、镍、锌、钼质控样品 | 30g/瓶 | 见证书 | |

| SUGG_227183 | (菠菜粉)蔬菜中铅、镉、铬、汞、砷、铜、镍、锌、钼质控样品 | 30g/瓶 | 见证书 | |

7. 玉米粉基体质控样

| 产品编号 | 产品名称 | 产品规格 | 标准值 | |

| SUGG_227181 | 玉米粉中镉质控样品 | 30g/瓶 | 见证书 | |

| SUGG_227186 | 玉米粉中铅、砷、镉、铬、汞质控样品 | 30g | 5组分 | |

| SUGG_227185 | 玉米粉中铅、镉、砷成分分析标准物质 | 30g | 3组分 | |

华为nova7se战nova6哪个好 华为nova7se参数战nova6辨别对比

广东省实有市场主体1572.5万户 数量居全国第一

光伏发展的重大战略机遇期 市场发展到底需要什么样的支持?,行业资讯

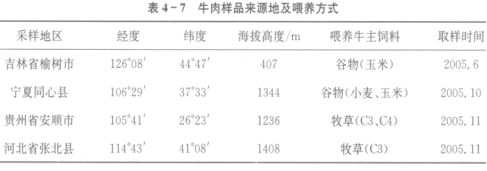

基于耦合技术的牛肉产地溯源(一)

《草木人间》释出未曝光片段 蒋勤勤被闺蜜欺骗

消费者超市购物遭遇捆绑销售 上海市奉贤区市场监管局立案调查